Homeowners Insurance in and around New Albany

Homeowners of New Albany, State Farm has you covered

The key to great homeowners insurance.

Would you like to create a personalized homeowners quote?

Welcome Home, With State Farm Insurance

New home. New adventures. State Farm homeowners insurance. They go hand in hand. And not only can State Farm help cover your home in case of fire or hailstorm, but it can also be beneficial in certain legal cases. If someone were to hold you financially accountable if they slipped at your residence, the right homeowners insurance may be able to cover the cost.

Homeowners of New Albany, State Farm has you covered

The key to great homeowners insurance.

Open The Door To The Right Homeowners Insurance For You

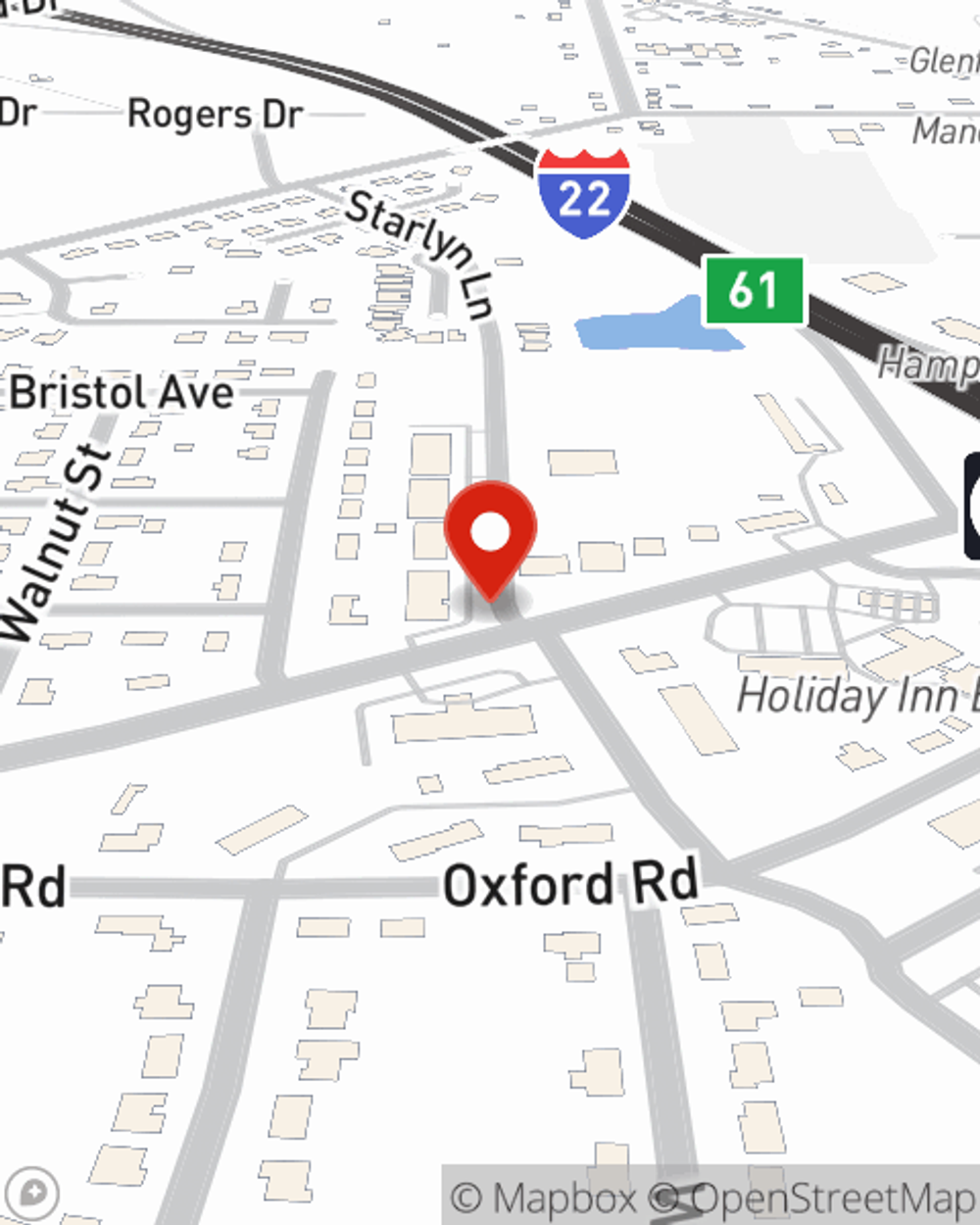

That’s why your friends and neighbors in New Albany turn to State Farm Agent Wally Morgan. Wally Morgan can walk you through your liabilities and help you choose the right level of coverage.

As a commited provider of home insurance in New Albany, MS, State Farm aims to keep your home protected. Call State Farm agent Wally Morgan today for help with all your homeowners insurance needs.

Have More Questions About Homeowners Insurance?

Call Wally at (662) 539-7062 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Boost your home pool safety

Boost your home pool safety

Safety reminders and guidelines to make sure your swimming pool or hot tub is ready for the season.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.

Wally Morgan

State Farm® Insurance AgentSimple Insights®

Boost your home pool safety

Boost your home pool safety

Safety reminders and guidelines to make sure your swimming pool or hot tub is ready for the season.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.